Going Beyond Payments: How Stripe Sigma Helps Businesses with Data Analysis

Going Beyond Payments: How Stripe Sigma Helps Businesses with Data Analysis

Introduction

In today’s data-driven world, businesses need to analyze vast amounts of data to make informed decisions and stay competitive. While Stripe is widely known for its payment processing capabilities, it also offers a powerful tool called Stripe Sigma that goes beyond payments, helping businesses harness the power of data analysis.

What is Stripe Sigma?

Stripe Sigma is a data analysis tool offered by Stripe, a leading online payment processing platform. It allows businesses to access and analyze their payment data easily. With Sigma, business owners can gain valuable insights into their transaction, subscription, and customer data. This enables them to make data-driven decisions that can drive business growth and profitability.

How does Stripe Sigma work?

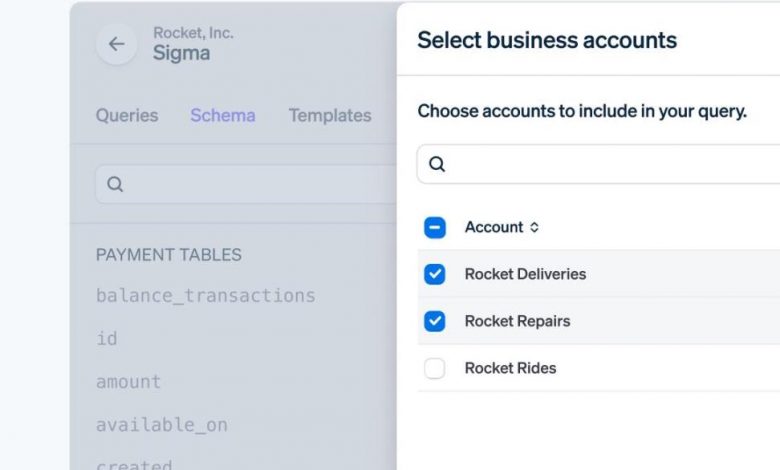

Stripe Sigma works by providing businesses with data visualizations and the ability to create custom reports in an intuitive and user-friendly interface. It integrates seamlessly with a business’s existing Stripe payment data, offering real-time insights and analytics. With Sigma, businesses can explore data across multiple dimensions, filter and group data based on specific criteria, and identify trends and patterns that were previously hidden.

Benefits of Using Stripe Sigma

1. Enhanced Decision Making

With Stripe Sigma, businesses gain access to comprehensive payment data analytics, enabling them to make well-informed decisions. By analyzing customer behavior, revenue trends, and subscription metrics, businesses can identify opportunities for growth, optimize pricing strategies, and improve overall customer satisfaction.

2. Customizable Reporting

Stripe Sigma enables businesses to create customized reports based on specific metrics, dimensions, and filters. This flexibility allows businesses to track the metrics that matter most to them, providing relevant insights tailored to their unique needs. From analyzing the performance of different payment methods to tracking customer churn rates, Sigma offers a range of customization options.

3. Seamless Integration

Stripe Sigma seamlessly integrates with a business’s existing Stripe payment data, eliminating the need for complex data exporting and importing. This ensures that businesses have access to up-to-date and accurate information for analysis. The seamless integration also enables businesses to automate reporting processes, saving time and resources.

Frequently Asked Questions (FAQs)

Q: How do I get started with Stripe Sigma?

Stripe Sigma is available to businesses on the Stripe platform. To get started, simply log in to your Stripe account, navigate to the dashboard, and select the Sigma tab. From there, you can explore the various reporting options and start analyzing your payment data.

Q: Can I combine Stripe Sigma with other data analysis tools?

Absolutely! Stripe Sigma offers the option to export data in various formats, such as CSV or JSON. This allows you to integrate it with your preferred data analysis tools or business intelligence platforms to gain deeper insights and perform more complex analyses.

Q: Is Stripe Sigma secure?

Stripe takes data security seriously. As a PCI Level 1 compliant payment processor, Stripe ensures that your payment data remains safe and secure. Additionally, Stripe Sigma offers role-based access controls, allowing you to control who can access and analyze your data.

Conclusion

Stripe Sigma provides businesses with a powerful data analysis tool that goes beyond payments. By leveraging the insights and analytics generated by Sigma, businesses can uncover hidden patterns, optimize decision-making, and drive growth. Whether you’re a small business owner or an enterprise, Stripe Sigma can help you harness the power of your payment data. Start exploring the possibilities and take your business to new heights.